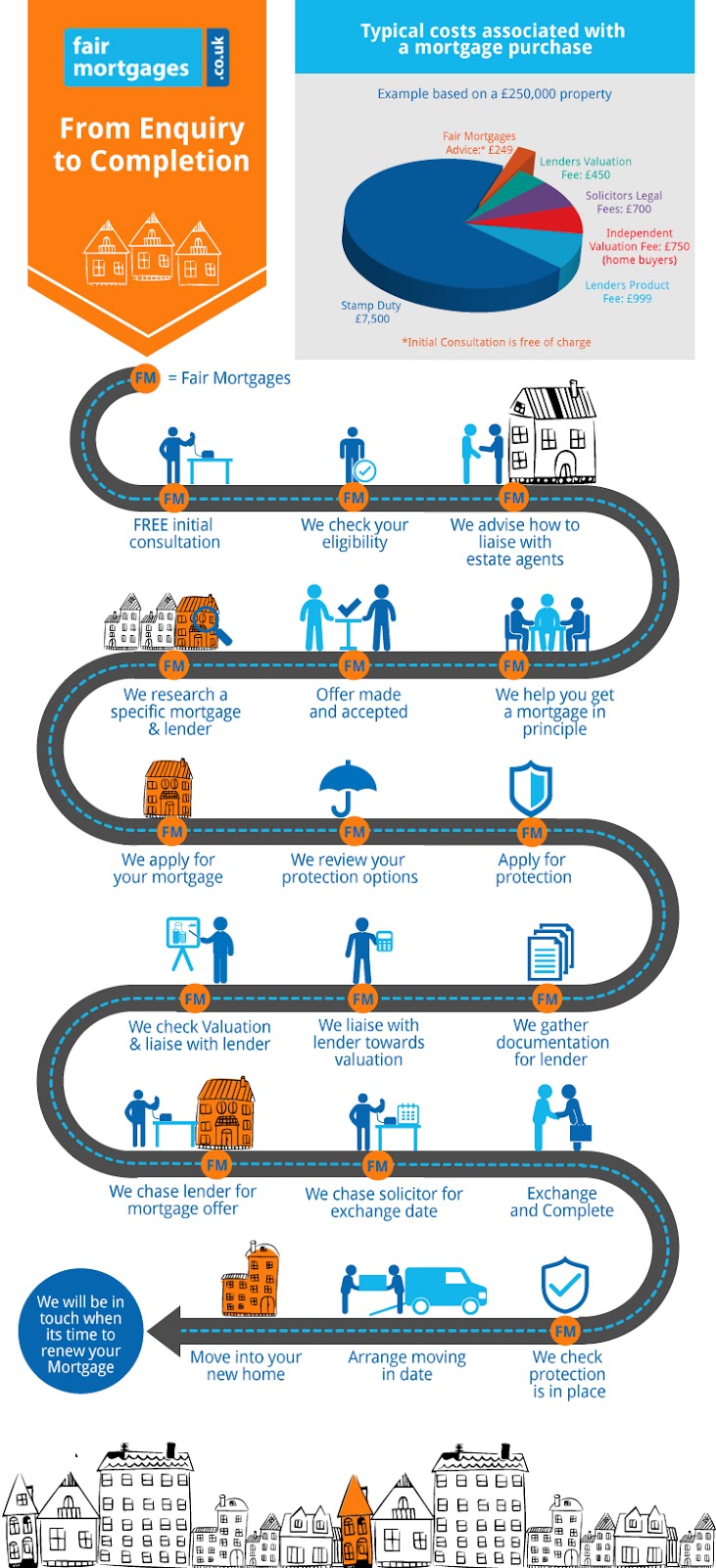

What is the mortgage application process?

Regardless of which mortgage provider you choose, the mortgage application process will follow the same basic steps. Here we explain each stage to help guide you through your mortgage application start to finish. You can also use our FREE online mortgage calculator to help you find the best mortgage deals for you.

Remember that the mortgage application process in Scotland is different from the mortgage application process in England and Wales

Mortgage application

Step 1 – Initial enquiries

There are a huge variety of different mortgages available, all with their own repayment methods, duration and additional features, so it makes sense to try and get as wide an overview of the market as possible before making any decisions. You can use our FREE online mortgage calculator to compare over 5,000 of the latest mortgage deals.

Once you have narrowed down a selection of mortgages that interest you, you can contact the lender for more information. After speaking to the lender you may be given a Key Features Illustration (KFI). This is a standardised document that provides all the facts, figures and features associated with the mortgage you are interested in.

Step 2 – The decision in principle

Once you have chosen the mortgage you would like to apply for, you can submit an application to the lender for a decision in principle (also known as an agreement in principle). This demonstrates to a seller that you are a serious buyer who can borrow enough money to purchase the property.

Step 3 – The mortgage application

Once you have obtained a decision in principle and have made an offer on a property, you can submit a full mortgage application to the lender. Under new FCA regulations, your lender is responsible for checking that you can afford repayments both now and in the future. You will be asked to demonstrate your income, existing debts, and monthly outgoings, and you will be asked if you expect your income or outgoings to change significantly in the near future. Your affordability will also be ‘stress-tested’ to ensure that you will still be able to make the repayments on your mortgage if interest rates increase in the future.

Although some execution-only mortgages are available (i.e. you manage the application process yourself, usually online, forfeiting the legal protection you would have from an advised mortgage) most prospective borrowers will need to have an interview with their prospective lender, or with an intermediary, to carry out affordability checks.

Step 3 – the survey and valuation

The lender will instruct a surveyor to conduct a valuation of the property. It is also advisable to get a more detailed survey of the property at this stage to check for any potential structural issues. There are several types of surveys available depending on the age and type of property you are looking to buy. If there are problems with the survey, the lender may ask for further checks to be made, or may refuse the mortgage altogether.

When a formal mortgage offer is issued, the borrower, lender and solicitor will all be given a copy. The offer formally states that they are prepared to lend subject to certain conditions that are usually confirmed by your solicitor. From this stage onwards it is normally down to your solicitor to complete the transaction and they will work with the seller’s solicitor to do so.

Step 4 – Completing the purchase

Your solicitor or conveyancer will send a report to your lender known as the 'report on title' which tells the lender the results of searches carried out on the property and gives details about the legal title to the land. Your lender will then check that everything in this report is in order and feed back to your solicitor. Following this, your solicitor will ask your lender to transfer the money you are borrowing to them. On the day of completion of the purchase, this money is transferred to the seller's solicitor and you will receive the keys to your new property.

To compare top mortgage interest rates and find the best mortgage deals for you, use the mortgage calculator to search over 5,000 mortgage deals based on your personal circumstances.